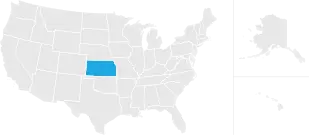

does kansas have estate tax

Updated December 21st 2021. How Much Are Real Estate Transfer Taxes in Kansas and Who Pays Them.

Frequently Asked Questions About Probate Kansas Legal Services

Kansas is not a friendly place when it comes to property tax rates for its residents.

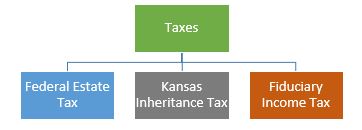

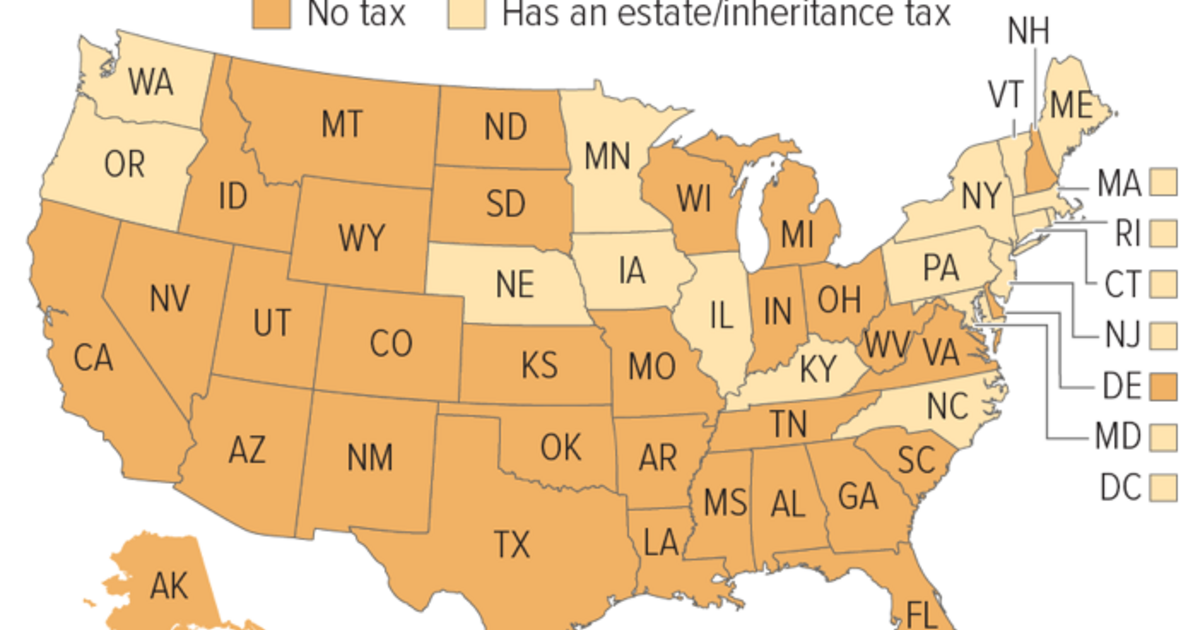

. Kansas began to phase out its estate tax in 2008 and completely eliminated the tax in 2010. While the typical homeowner in Kansas pays just 2235 annually in real estate taxes property tax rates are fairly high. Kansas does not have an estate tax or inheritance.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Enter your financial details to calculate your taxes. Real estate transfer fees used to be complex in Kansas but have.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. States counties and municipal authorities may impose transfer taxes on real estate sales. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The size of the inheritance. Kansas does not have an estate or inheritance tax.

Natalie Wallington The Kansas City Star 4292022. With a property tax rate of 137compared to a national average of 107you stand to be hit with a hefty property tax bill every year. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. Kansas does not have an estate tax but residents of the Sunflower State may have to pay a federal estate tax if their estate is of sufficient size. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Your average tax rate is 1198 and your marginal tax rate is. Property Tax Savings in the Sunflower State With a Kansas Safe Senior Property Tax Refund. To find a financial advisor who serves your area try our free online matching tool.

Many cities and counties impose their. The median property tax in Kansas is 162500 per year for a home worth the median value of 12550000. Kansas is tough on homeowners.

As of 2013 estates in Kansas are not subject to a state-level estate tax. Kansas Income Tax Calculator 2021. The federal estate tax applies to.

Counties in Kansas collect an average of 129 of a propertys assesed fair. Hi does kansas have an inheritance tax. The states average effective property tax rate.

29After years of partisan conflict Kansas state Legislature passed a bill late Thursday night to eliminate the states. The state sales tax rate is 65. Kansas Real Estate Transfer Taxes.

The Ultimate Guide To Kansas Real Estate Taxes

License Plate Game Scavenger Hunt Printable Board Games Free Printable Games Activities For Kids

Kansas Estate Tax Everything You Need To Know Smartasset

Kansas Estate Tax Everything You Need To Know Smartasset

Personal Injury Lawyers Toronto Ontario S Top Rated Personal Injury Lawyer Small Business Loans Law Firm Business Loans

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Kansas Estate Tax Everything You Need To Know Smartasset

Low Income Apartments With No Waiting List Low Income Apartments Low Income Income

Property Tax Kansas County Treasurers Association

Tornado Alley On Us Map Tornado Alley Tornado Tennessee Tornado

Kansas Income Tax Calculator Smartasset

Get A Kansas Real Estate License Online Pricing Packages Real Estate License Real Estate Classes Business Ebook

Pin By Ash H On What We Work For Woodlands House Columns French Estate

10 Oldest Cities In The United States Old City City Estate Tax

Kansas Last Will And Testament Legalzoom

Top State Mover Kansas Rebounds From Tax Cutting Disaster

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Kansas Sales Tax Rates By City County 2022

Best States To Retired In With The Lowest Cost Of Living Finance 101 Gas Tax Healthcare Costs Cost Of Living